The commonwealth of Massachusetts announced the employer and employee contribution rates that will apply beginning on July 1, 2019, to finance the state’s paid family leave law. The law requires up to 12 weeks of paid family leave, up to 20 weeks of paid medical leave for an employee with a serious health condition and up to 26 weeks to care for a covered service member. The fund will start paying some benefits Jan. 1, 2021, and full implementation of the new benefits will be in effect by July 1, 2021. We discussed the nuts and bolts of the law in our Alert.

New payroll tax

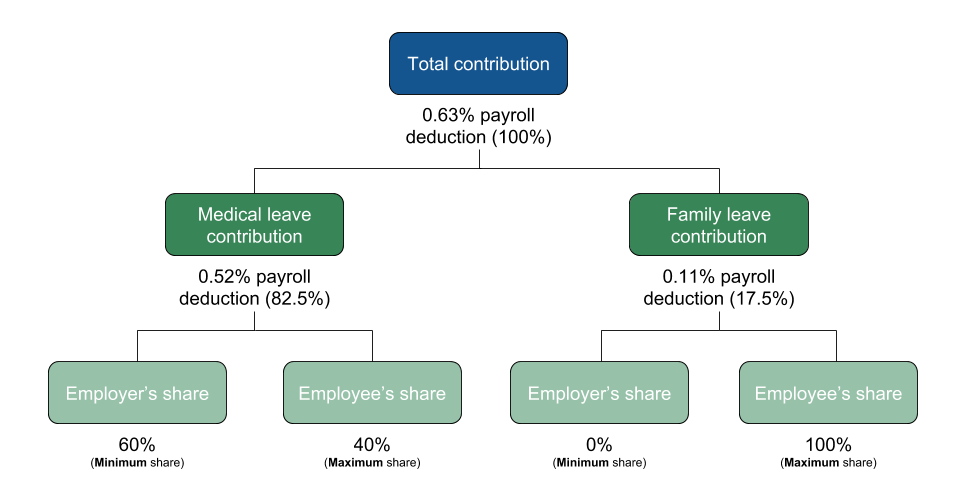

Beginning July 2019, a new payroll tax will go into effect. It’s a shared tax between the employee and employer equivalent to .63 percent of the employee’s wages, up to the Social Security wage base of $132,900 (2019). Employers with 25 or more employees in Massachusetts may deduct the entire amount of the payroll tax from an employee’s wages for family leave and up to 40 percent of the payroll tax for medical leave.

The total contribution of .63 percent of payroll is split between the medical leave contribution (.52 percent of payroll) and the family leave contribution (.11 percent of payroll). The state’s website contains the following schematic illustrating the tax and payroll deductions. The illustration below applies to employers with 25 or more employees.

Lockton comment: Employers with fewer than 25 employees are excused from paying the 60 percent share of the medical leave contribution, but they are required to deduct from employees’ wages the remaining 40 percent of the medical leave contributions and 100 percent of the family leave contribution.

What’s next?

Proposed regulations issued earlier this year indicate that employers will need to file quarterly reports with the state’s tax authority from which the state will assess the tax (to be paid 30 days after the end of the quarter), although the rules do not address when the filing requirement begins. The state intends to issue final regulations by April 1.

Although employers must start remitting the payroll tax on July 1, 2019, benefits will not be available until January 2021. Employers with Massachusetts workers will want to stay tuned for further developments.

Thea needs to be a way to opt out of this I have no qualifying family members who I will need to take a leave for and feel it is highly unfair to tax me on this

Yes, also I would like to stop paying for highways because I don’t drive and the military because I don’t believe in war.

this would actually be fair.

Kini i disagree with your statement people already pay for short and long term this will be another government run fund being abused by people who shouldn’t qualify and government officials using it like another rainy day fund

They just created another bureaucracy. We are getting out within 2 years. Taxed to death.

Welcome to the people’s republic of Massachusetts. Get used to the taxes. Opt out? Are you serious? Pay and shut up and for heavens sake keep voting democrat. That way the government can continue to grow and grow

Disgusting this tax is. You should be able to opt out

Bill, you’re right, and we have the old bags, the 65+ crowd to thank for that, they still have the ignorant mentality that Democrats are fighting for poor people, and the Republicans are just looking out for the rich.

It’s too bad an IQ test isn’t required to cast a vote in any and all elections, then we might have a chance at some positive change in MA that would benefit the working tax payers and not the senior citizens that are living into their 90’s collecting 10X more social security and Medicare than they ever paid in, but of course they’re entitled to that right? They’re entitled to NOTHING!!!

Why do people who don’t have nor want to participate be forced to

This really angers me. I will never use this and yet it will cost us over $700 per year! This is money i could be contributing towards my retirement fund. Can you imagine the FRAUD we’ll all be paying for??! With my 700 per year. This lazy ass wasteful government doesn’t gives hoot about the hardworking taxpayer. Charlie Baker signed this bill.

I work part time and plan on quitting next year so I would never be using the program, There should be a way to opt out.

We should not be forced to pay for something we don’t want. It’s just another way for the government to control things and take our money. Will the money be available if/when we do need it or will it have disappeared like Social Security??

You are forced to participate because you live in the Peoples Republic of Massachusetts. Think before you vote.

i agree

Just another way for the working stiffs in MA to pay. It sure is great when an employer with over 1500 employees can get out of paying their share but the employees of said company still have to pay even though we have a very generous leave program. I’m sure the state will find a way to plunder any funds that are “left” in the fund.

You can always work in a different state.

I am a brand new mother, this new policy won’t benefit me directly and every dollar of my income is needed at home right now. However, I am happy to contribute this small amount because I know it will benefit other new moms, dads, and any of us who have to care for aging parents or even ourselves in times of illness. A small bit out of my paycheck could make a world of difference to someone else, I only wish it would have come sooner.

Feel free to pony up your contribution to your coworkers if it will make you happy to let them have a 12 week paid vacation.

Don’t make me pay for your generosity. I seem to have other priorities than you do.

Stop complaining. I’m sure the tax rates will only go down over time.

I have retired and my husband will do so in a couple of years. We have taken insurance to ensure we are covered in case of Long Term care requirements. It seems we are being mandated to provide charity for others.

You might need this someday. Maybe not right now, but accidents and medial emergencies happen whether you’re prepared or not.

I don’t like the decrease in the paycheck but I’ll have some peace of mind in the event of an emergency.