The Office of Civil Rights of the US Department of Health & Human Services (HHS) has issued new, final regulations that will prohibit discrimination in health activities and programs (including some employer health plans) for plan years beginning in 2017. The more than 360 pages of HHS guidance addresses a multitude of topics related to discrimination on the basis of race, color, national origin, sex, age or disability. We’ll turn our attention to only one of the topics addressed in the regulations: discrimination based on gender identity.

Lockton comment: Discrimination based on gender identify is an emerging HR/legal issue. In December 2014, President Obama signed an Executive Order prohibiting federal contractors from discriminating on the basis of sexual orientation or gender identity. And earlier this month the Equal Employment Opportunity Commission (EEOC) issued a “right to sue” letter for a transgender nurse who alleged his employer, a hospital system, discriminated against him by not providing for gender transition healthcare services under its health plan.

The regulations themselves are obtuse and provide little practical guidance on what is and is not prohibited discrimination based on gender identity. It’s also important to note that the rules do not apply to all employers or their health plans, but virtually all healthcare providers will see their group health plans fall under the rules’ scope, as will many employers that purchase group insurance. Employers that dodge the rules (typically, self-insured employers that are not healthcare providers) nevertheless risk gender bias claims for not playing along.

For health plans subject to the regulations, the rules are clear that the plan may not:

- Include a categorical exclusion of health services related to gender transition. Unfortunately, HHS declined to provide a definition of what qualifies as “services related to gender transition,” although HHS says it intends to interpret the rule broadly to include hormone therapy, psychotherapy (e.g., for gender dysphoria) and even surgical treatment. HHS says such treatment may be appropriate over a person’s lifetime, implying that annual limits on which such services will be provided will also be problematic.

- Deny or limit benefits (or impose special cost-sharing requirements) for medically appropriate, gender-specific healthcare simply because the covered person identifies himself or herself as being of a gender for whom the care would not normally be appropriate, or because of the gender under which the person is identified on the health plan’s rolls. Thus, the plan may not deny coverage for medically appropriate ovarian cancer care for a transgender individual who now identifies himself as a man. Similarly, the plan may not deny coverage for medically appropriate well-woman care simply because the health plan’s rolls identify the person as a man but the individual is a transgender female.

- May not categorically exclude gender transition-related services as “experimental” or “cosmetic.”

On the other hand, the rules indicate that a health plan does not have to cover any particular procedure or treatment and may apply “neutral, nondiscriminatory standards that govern the circumstances in which it will offer coverage to all its enrollees in a nondiscriminatory manner.”

Lockton comment: Thus, categorical exclusions for transgender surgery and the related hormone therapy and psychotherapy are not allowed, although the required extent of coverage for these and other transgender-related services remains a bit unclear. As a practical matter, HHS appears to leave these questions of interpretation for the courts or other government agencies, such as the EEOC, the federal agency responsible for enforcing employment nondiscrimination laws.

To Whom and How the Regulations Apply

The starting point in our analysis is who qualifies as a “covered entity” under these rules. Do not confuse this terms with “covered entity” as it is used in the context of the HIPAA privacy rules, because in this case, it’s a different concept.

For purposes of these rules, a covered entity means any entity that operates a health program or activity that receives federal financial assistance. This includes hospitals and other healthcare providers that, for example, receive Medicare or other federally funded reimbursements, and health insurers that provide Medicare Advantage or Medicare Part D coverage, or sell health insurance in the Affordable Care Act’s online public health insurance marketplaces (because these latter insurers receive federal payments to reduce enrollees’ deductibles and other cost-sharing amounts, and may receive certain transitional risk mitigation payments as well).

Significantly, the rules reach not just the manner in which these entities provide care to their patients or insurance to their customers, but also the group health plans providing benefits to these entities’ own employees.

Lockton comment: This means an employer that is a healthcare provider will be directly subject to the new rules, as will its health plan. HHS indicated that “if a hospital provides health benefits to its employees, it will be covered by [the nondiscrimination rules]… not only for the services it offers to its patients or other beneficiaries but also for the health benefits it provides to its employees.”

The rules do not provide a specific “conscience clause” that allows covered entities that are religious organizations to opt out of the rules. However, HHS won’t apply the requirements when doing so would violate the Religious Freedom Restoration Act of 1993. That law holds the federal government cannot substantially burden a person’s exercise of religion without a compelling governmental interest that cannot be satisfied by any less restrictive means responsible for protecting religious rights.

The extent to which a non-healthcare provider’s plans may fall under the rules depends on whether the plans are insured or self-insured.

Insured Employer Plans

Because many health insurers fall under the rules’ scope, where an employer purchases health insurance from the insurer, the insurer will likely include gender transition services in its insurance contract, so as to ensure it is complying with the regulations. It seems to make no difference that the employer is purchasing its group coverage outside a public insurance marketplace or other program (such as Medicare Advantage) that accepts federal monies.

Self-funded Plans

What about an employer that self-funds its health plan? The good news here is the health plan itself is not a covered entity under these rules (unless, of course, the plan sponsor is a healthcare provider). However, those crafty regulators at HHS have found another way to implicate self-funded plans.

Most self-funded employer plans use a third party administrator (TPA) to pay claims. Often the entity acting as TPA is also an insurance company that provides these claims administration services in addition to traditional insurance. According to HHS:

“Third-party administrator services are undeniably a health program or activity, as they involve the administration of health services. Under the final rule, if an entity that receives Federal financial assistance is principally engaged in providing or administering health services, health insurance coverage, or other health coverage, then, . . . all of its operations are covered.”

HHS will investigate the TPA if it gets a complaint that the TPA is administering the plan in a discriminatory manner, such as denying any medical claims simply because the claimant is transgendered. In contrast, discriminatory plan design will be investigated by HHS when the plan sponsor is a covered entity (e.g., healthcare provider). Otherwise, HHS will refer the matter to the EEOC to investigate.

Lockton comment: In other words, where a non-healthcare provider offers health insurance to its employees under a self-insured plan, HHS may take aim at the TPA if the TPA is otherwise a covered entity (e.g., an insurer that receives federal funds) and its claims administration system causes gender identity discrimination because, for example, the system categorically denies benefits for a well-woman exam to a covered person who is a transgender female, simply because the person is listed as a male in the TPA’s enrollment database.

Where the TPA discriminates on the basis of gender identity because of plan design (e.g., its client’s health plan categorically excludes transgender services), HHS lacks authority to intervene, but says it may refer the employer to the EEOC for potential investigation on account of transgender discrimination.

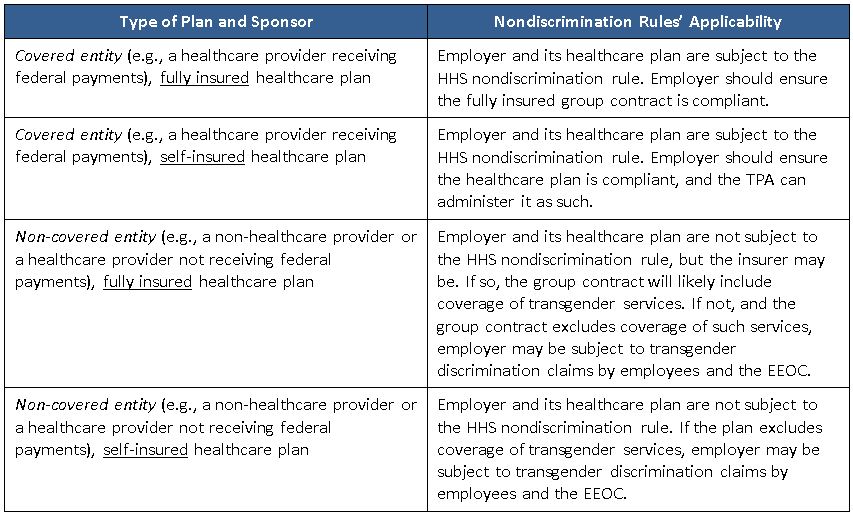

Here is how the HHS nondiscrimination rules appear to apply to group healthcare plans, depending on the nature of the plan sponsor and the insured or self-funded nature of its group healthcare plan:

How Will All This Play Out?

As you would expect, there are relatively few individuals who are interested in pursuing gender transition services, so there is very low utilization associated with this coverage. Consequently, it is not a big ticket item for most health plans to add, if the sponsor is self-funded, not a healthcare provider, and simply wants to moot any potential issue with the EEOC or with the court of public opinion. Most of the major insurers and TPAs have medical management guidelines in place for these services. In order to qualify for gender reassignment surgery, the individual must satisfy the plan’s protocols for counseling, hormone therapy, and so on. Several large employers cover these services, subject to the plan’s strict protocols.

That being said, there are some employers that will not want to cover gender transition services under their health plans. This may be due to deeply held religious or ideological beliefs. Those employers will need to weigh the compliance risks of regulatory actions, litigation and negative press. As the saying goes, no employer wants to be the “test case” on a nascent legal issue.

We expect many self-funded plans will move toward providing coverage for gender transition services, subject to medical management protocols that should help mitigate any cost impact to the plan. Many TPAs and insurers are already suggesting their clients add this coverage for 2017.

Self-funded employers that do not want to provide the coverage due to ideological or religious reasons are in a tough spot, especially if they are also healthcare providers that are directly subject to the rules.

Later this year, we expect many TPAs may be asking their clients for written assurances that their plan design passes muster next year under the regulations and may want indemnification in the event HHS determines there is discriminatory plan design.